There is no one policy or campaign that will single-handedly invigorate the UK capital markets, but tackling the low level of UK pension investment in UK-listed businesses comes close.

Our survey of FTSE leaders – Raised in London 2024 – found that increasing pension investment would be the single most welcome development, with 94% saying greater investment from pension funds would make a material difference to valuations and encourage more IPOs on the UK market.

The decline in UK pension fund investment in the UK stock markets has been one of the most significant changes over the last quarter of a century, as UK pension fund allocations to UK equities has fallen to 4.4%, down from over half their assets 25 years ago. [1]

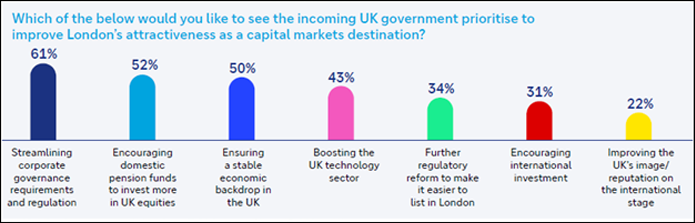

It is therefore perhaps unsurprising that encouraging pensions investment was named by 52% of survey respondents as a high priority for government policy on the City (second only to streamlining corporate governance requirements at 61%). Action to encourage that investment is one of our key recommendations based on the report findings.

Investment into UK equities by domestic pension funds will likely be key to the government’s objective of increasing investment in UK infrastructure – a task that, with public coffers stretched to their limits, will likely need to be taken up by UK investors and businesses.

The Mansion House Reforms outlined by the previous Chancellor last year highlighted ways for the financial services industry to unlock capital, including the industry-led compact committing many of the UK’s largest Defined Contribution pension providers to the objective of allocating at least 5% of their default funds to unlisted equities by 2030. Meanwhile, the newly installed Chancellor has announced a wholesale review of UK pensions with a wide range of objectives, including to increase investment in UK markets.

Whatever policy solutions might emerge, the case for increased UK equity investment by pensions is already having an effect on expectations. Our survey found that 76% of FTSE leaders think pension funds will increase UK equity allocations over the coming two years, though it should be noted that this expectation has moderated slightly since last year’s survey, in which 80% expected such allocations to rise. This suggests that it is hugely important to maintain the momentum on this issue.

Exactly how increased pension investment in UK equities can be encouraged will require careful consideration, but should include an analysis of what has caused the decline in that investment over the last quarter of a century, including, for example, whether accounting rules on pension fund accounting or an excessive risk-averse culture amongst pension fund trustees has contributed to declining UK equity allocations. The Capital Markets Industry Taskforce (CMIT) are aligned with pushing the conversation on this - their recent report on the capital markets highlights the importance of greater UK investment in our domestic companies, as well as restoring the UK’s risk appetite.[2]

Last week’s budget announcement included a plan to apply inheritance tax to unspent pensions from April 2027. The importance of this will vary from case to case and it will take time to see how this might affect investment behaviour. However, in the months ahead, it is important for all industry stakeholders to actively engage in debate that could influence the government’s pension review. Raised in London 2024 provides clarity on current FTSE leader sentiment, and City advisers and politicians of all parties are in broad agreement as to the objective of the pension review.

The potential significance of a shift is enormous. While the decline of pension fund investment in UK equities is concerning, it also demonstrates the scale of the opportunity. Even a modest reversal in this trend could be transformational for the fortunes of London as a financial hub and for UK PLCs.

There is no one policy or campaign that will single-handedly invigorate the UK capital markets, but tackling the low level of UK pension investment in UK-listed businesses comes close.

Our survey of FTSE leaders – Raised in London 2024 – found that increasing pension investment would be the single most welcome development, with 94% saying greater investment from pension funds would make a material difference to valuations and encourage more IPOs on the UK market.

The decline in UK pension fund investment in the UK stock markets has been one of the most significant changes over the last quarter of a century, as UK pension fund allocations to UK equities has fallen to 4.4%, down from over half their assets 25 years ago. [1]

It is therefore perhaps unsurprising that encouraging pensions investment was named by 52% of survey respondents as a high priority for government policy on the City (second only to streamlining corporate governance requirements at 61%). Action to encourage that investment is one of our key recommendations based on the report findings.

Investment into UK equities by domestic pension funds will likely be key to the government’s objective of increasing investment in UK infrastructure – a task that, with public coffers stretched to their limits, will likely need to be taken up by UK investors and businesses.

The Mansion House Reforms outlined by the previous Chancellor last year highlighted ways for the financial services industry to unlock capital, including the industry-led compact committing many of the UK’s largest Defined Contribution pension providers to the objective of allocating at least 5% of their default funds to unlisted equities by 2030. Meanwhile, the newly installed Chancellor has announced a wholesale review of UK pensions with a wide range of objectives, including to increase investment in UK markets.

Whatever policy solutions might emerge, the case for increased UK equity investment by pensions is already having an effect on expectations. Our survey found that 76% of FTSE leaders think pension funds will increase UK equity allocations over the coming two years, though it should be noted that this expectation has moderated slightly since last year’s survey, in which 80% expected such allocations to rise. This suggests that it is hugely important to maintain the momentum on this issue.

Exactly how increased pension investment in UK equities can be encouraged will require careful consideration, but should include an analysis of what has caused the decline in that investment over the last quarter of a century, including, for example, whether accounting rules on pension fund accounting or an excessive risk-averse culture amongst pension fund trustees has contributed to declining UK equity allocations. The Capital Markets Industry Taskforce (CMIT) are aligned with pushing the conversation on this - their recent report on the capital markets highlights the importance of greater UK investment in our domestic companies, as well as restoring the UK’s risk appetite.[2]

Last week’s budget announcement included a plan to apply inheritance tax to unspent pensions from April 2027. The importance of this will vary from case to case and it will take time to see how this might affect investment behaviour. However, in the months ahead, it is important for all industry stakeholders to actively engage in debate that could influence the government’s pension review. Raised in London 2024 provides clarity on current FTSE leader sentiment, and City advisers and politicians of all parties are in broad agreement as to the objective of the pension review.

The potential significance of a shift is enormous. While the decline of pension fund investment in UK equities is concerning, it also demonstrates the scale of the opportunity. Even a modest reversal in this trend could be transformational for the fortunes of London as a financial hub and for UK PLCs.

[1] New Financial, Comparing the asset allocation of global pension systems (September 2024)

[2]CMIT - Capital Markets of Tomorrow (6 September 2024)