Deutsche Numis’ Raised in London 2024 report reveals upbeat outlook for UK market, while uncovering key ways to secure its future.

London is Europe’s leading capital market.1 It attracts international capital, helps finance the UK’s growth companies and makes a significant contribution to the domestic economy, all of which create employment and opportunities far beyond the square mile. The UK financial services industry accounts for approximately 12% of GDP, providing about 2.5 million jobs and generating billions of pounds in taxes that help fund our public services.2

The continued competitiveness and growth of the UK capital markets is vital for the success of UK business and industry, and the country’s prosperity. Regulators and policymakers therefore need to keep a constant eye on London’s competitiveness and, where necessary, take steps to reinforce its success.

Raised in London is our contribution to that process, monitoring the view of FTSE leaders and identifying areas in policy and practice where London can be strengthened. Last year, we made the case for regulatory reform within our report’s recommendations and as a result of key UK markets stakeholders combining their efforts, this has now been achieved with the Financial Conduct Authority (FCA)’s recent significant amendments to the UK Listing Rules and the current FCA consultation around the Prospectus Regime.

Confident and competitive

Current UK PLC sentiment on London’s outlook is strong. Our report revealed that FTSE leaders, including CEOs, CFOs and Chairs, remain positive on the future for London as a capital markets venue, while still keen to see greater attention given to key areas, such as over-rigid corporate governance and encouraging greater investment into UK equities from domestic pension funds.

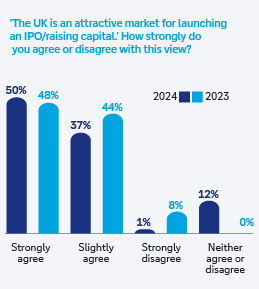

The overwhelming majority (87%) of the more than 150 FTSE leaders who took part in our survey agree that the UK continues to be an attractive market for an IPO or capital raising. Just 1% of respondents strongly disagreed with that statement, a significant drop from 8% last year.

FTSE leaders were also upbeat about prospects, with 82% of respondents saying London would become more competitive as a capital markets venue over the next two years. However, this optimistic outlook was down from 90%, a drop of eight percentage points on last year’s survey. This dip is likely due to sentiment that, against the backdrop of the updated Listing Rules, the trend of London’s competitiveness improving has reached its peak.

Steps to strengthen London

Positive measures have been announced, or are already underway, to fortify London’s domestic and international appeal.

The reforms to the Listing Rules will streamline capital raising and almost all of our respondents (99%) felt that these changes would make London more attractive as a capital markets venue.

But our survey also indicated that FTSE leaders believe more can be done. The top priorities respondents would like to see the new UK government focus on include streamlining corporate governance at 61% and encouraging UK pension funds to increase their allocations to UK equities at 52%. FTSE leaders were also keen to see encouragement for the development of one or more super-sectors in the UK market, with sectors underpinned by technology and innovation making up 46% of responses on what the super-sector should be.

Raised in London 2024 reveals a clear positive mood among FTSE leaders and strong approval for the steps already taken to grow London’s appeal. Maintaining that leading position among global capital markets has never been more important and our Raised in London 2024 findings and resultant recommendations help point the way to how this can be achieved with input from key stakeholders across the UK capital markets.

1.London Stock Exchange, London listed companies have a total value of £5.0 trillion, £2.4 trillion more than the next largest European exchange - report (August 2024) 2.State of the sector: annual review of UK financial services (2023)

Deutsche Numis’ Raised in London 2024 report reveals upbeat outlook for UK market, while uncovering key ways to secure its future.

London is Europe’s leading capital market.1 It attracts international capital, helps finance the UK’s growth companies and makes a significant contribution to the domestic economy, all of which create employment and opportunities far beyond the square mile. The UK financial services industry accounts for approximately 12% of GDP, providing about 2.5 million jobs and generating billions of pounds in taxes that help fund our public services.2

The continued competitiveness and growth of the UK capital markets is vital for the success of UK business and industry, and the country’s prosperity. Regulators and policymakers therefore need to keep a constant eye on London’s competitiveness and, where necessary, take steps to reinforce its success.

Raised in London is our contribution to that process, monitoring the view of FTSE leaders and identifying areas in policy and practice where London can be strengthened. Last year, we made the case for regulatory reform within our report’s recommendations and as a result of key UK markets stakeholders combining their efforts, this has now been achieved with the Financial Conduct Authority (FCA)’s recent significant amendments to the UK Listing Rules and the current FCA consultation around the Prospectus Regime.

Confident and competitive

Current UK PLC sentiment on London’s outlook is strong. Our report revealed that FTSE leaders, including CEOs, CFOs and Chairs, remain positive on the future for London as a capital markets venue, while still keen to see greater attention given to key areas, such as over-rigid corporate governance and encouraging greater investment into UK equities from domestic pension funds.

The overwhelming majority (87%) of the more than 150 FTSE leaders who took part in our survey agree that the UK continues to be an attractive market for an IPO or capital raising. Just 1% of respondents strongly disagreed with that statement, a significant drop from 8% last year.

FTSE leaders were also upbeat about prospects, with 82% of respondents saying London would become more competitive as a capital markets venue over the next two years. However, this optimistic outlook was down from 90%, a drop of eight percentage points on last year’s survey. This dip is likely due to sentiment that, against the backdrop of the updated Listing Rules, the trend of London’s competitiveness improving has reached its peak.

FTSE leaders were also upbeat about prospects, with 82% of respondents saying London would become more competitive as a capital markets venue over the next two years. However, this optimistic outlook was down from 90%, a drop of eight percentage points on last year’s survey. This dip is likely due to sentiment that, against the backdrop of the updated Listing Rules, the trend of London’s competitiveness improving has reached its peak.

Steps to strengthen London

Positive measures have been announced, or are already underway, to fortify London’s domestic and international appeal.

The reforms to the Listing Rules will streamline capital raising and almost all of our respondents (99%) felt that these changes would make London more attractive as a capital markets venue.

But our survey also indicated that FTSE leaders believe more can be done. The top priorities respondents would like to see the new UK government focus on include streamlining corporate governance at 61% and encouraging UK pension funds to increase their allocations to UK equities at 52%. FTSE leaders were also keen to see encouragement for the development of one or more super-sectors in the UK market, with sectors underpinned by technology and innovation making up 46% of responses on what the super-sector should be.

Raised in London 2024 reveals a clear positive mood among FTSE leaders and strong approval for the steps already taken to grow London’s appeal. Maintaining that leading position among global capital markets has never been more important and our Raised in London 2024 findings and resultant recommendations help point the way to how this can be achieved with input from key stakeholders across the UK capital markets.

1.London Stock Exchange, London listed companies have a total value of £5.0 trillion, £2.4 trillion more than the next largest European exchange - report (August 2024)

2.State of the sector: annual review of UK financial services (2023)